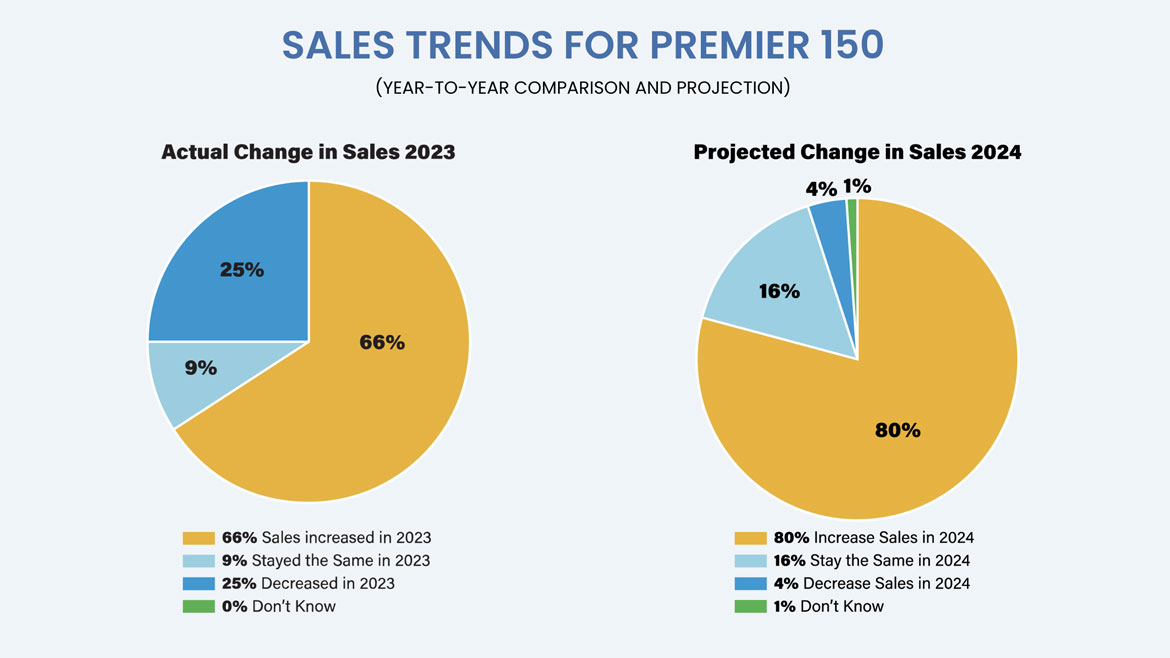

The 2024 Premier 150 Distributor Survey results — which are based on fiscal year-end 2023 revenue — are the first in three years to show any decrease in overall sales amongst participating PHCP-PVF wholesaler-distributors. In both 2021 and 2022, 100% of survey takers reported an increase in total sales. In 2023 that number dropped to 66% meaning 25% of companies had a decrease in sales while 9% reported that sales remained the same.

This drop doesn’t mean things are looking gloomy for PHCP-PVF distributors; it means sales numbers are leveling off as the market comes off two highly inflated, post-COVID years. Needless to say, the Premier 150 surveys from 2021 and beyond reflected sales numbers heavily impacted by the aftermath of COVID-19, and the numerous, ongoing economic impacts which followed. Perhaps in 2024, we can now say that PHCP-PVF distribution revenue is returning to a more “normal” pattern.

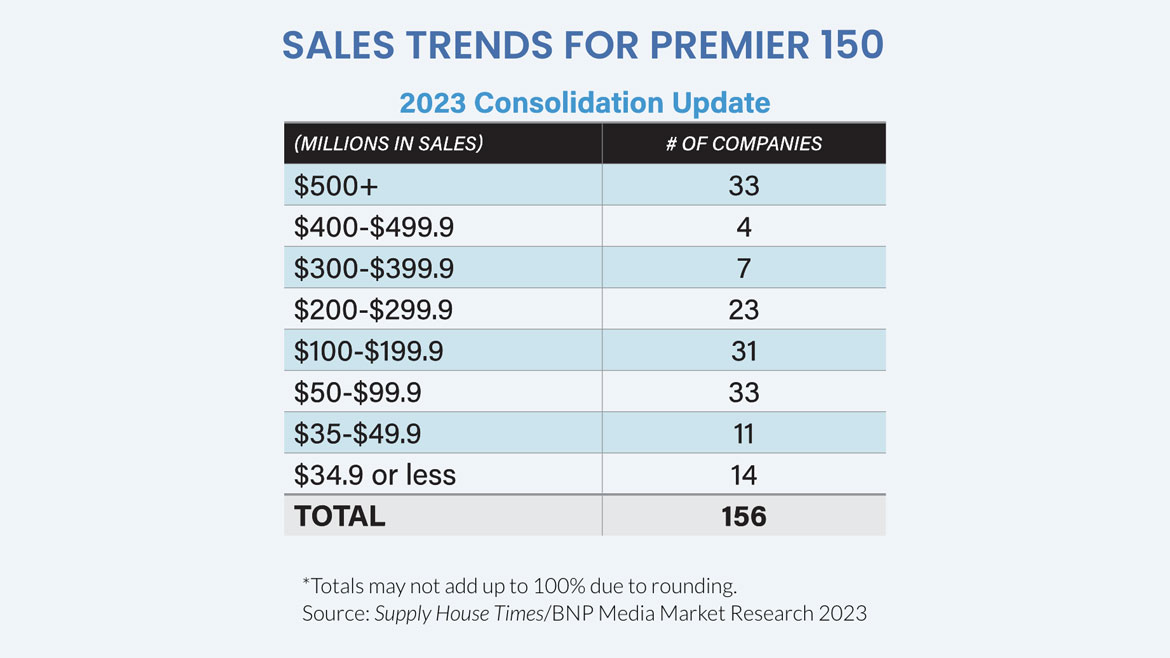

Each year, the Premier 150 Distributors survey is conducted by BNP Media Market Research. BNP Media is the parent company of Supply House Times. The data from the survey is used to rank the top 150 PHCP-PVF industry distributors based on each company’s reported sales from the previous fiscal year. This list is based off fiscal year 2023. Company sales numbers are never disclosed. Estimates are used in cases where companies do not complete the survey. Editors make these estimates based on information made available through various channels and industry partners such as the American Supply Association (ASA), PHCP-PVF buying groups, regional associations, as well as through Supply House Times’ digital outlets.

Return to normalcy

Although sales numbers in 2023 were down for many companies, leaders are happy with growth and performance, noting the drop in sales is due to comparing 2023 to previous, out-of-the-ordinary, record-breaking years.

Alex Beecher, director of marketing for Maryland-based R.E. Michel Co. explained that 2023 was down in comparison to previous years. “2023 was a regression to the mean after some very strong years,” he said. “We anticipate 2024 to be a return to normalcy with modest sales growth.”

President of Oklahoma City-based Locke Supply Co. John Orman III said 2023 was a “resetting” year with cost increases settling and supply chain healing.

Malorie Osypian, marketing manager for VP Supply Corp. out of New York said the supply chain is more balanced than in recent years. “Since the unprecedented markets of 2020-2023, we have seen a more balanced scenario this year,” she said. “There are fewer homebuyers, so we are focusing on serving multi-build engineers and developers. Our aim is to help them become leaders in the industry and to contribute to the improvement of the overall market.”

Similarly, Stan Allen, Maryland-based Northeastern Supply’s president said, “The 2023 fiscal year was soft with price deflation in regards to commodities. We see signs of improvement in 2024 with anticipated growth of approximately 5%.”

One industry source out West explained 2023 was soft in comparison to previous years, but she isn’t concerned. “2023 sales were almost flat (just slightly down) from the previous fiscal year. Considering that 2022 was an exceptional year for us as a company, and we had just come off of three straight years of 20% growth YOY, we were not too concerned,” she said. “Entering 2024, the goals we've set as a company and with managers, are all based on more normalized growth patterns. We still are pushing for aggressive growth in Sales and GP, and have set some significant strategic initiatives in place to help accomplish those goals, but we cannot expect to see the 20%+ growth YOY that we saw throughout COVID. With this in mind, we project a 5-6% growth rate in sales in 2024 over 2023.”

Scott Di Salvo, director of Venturi Supply, parent company to Tri-Star Industrial, Ameripipe and BPS Supply Group, said 2023 started strong but slowed down during the second half.

“2023 saw significant strength in the first half of the year which was a continuation of the economic expansion cycle coming out of COVID with an equally significant slowdown in the second half of the year,” he said. “We expect this slowdown to continue throughout 2024 and to be spurred by projected cuts in the Federal Funds rate with lagging impact to be felt in Q2/Q3 2025. Overall, there is strength in specific markets and sectors, but strength is not being felt across the industry or country as a whole.”

Another industry source from the Western U.S. said, “Although 2023 brought an overall ~9% decrease in top line sales, we were able to improve our margins and ended the year profitably. Expecting 2024 to look a little like a repeat of 2021 in terms of top-line sales (some growth), but higher costs will squeeze our bottom line.

One industry source said 2023 was an uphill climb. “The year was an uphill battle, but we took market share. We expect conservative organic topline growth for 2024 and have some new locations that should enhance this.”

While some distributors experienced a soft 2023, other enjoyed record years. Paul Gentile, president and CEO of Miami, Florida-based Lion Plumbing Supply said 2023 was the company’s largest revenue year to date. “Last year was our biggest year ever in company history. The economic climate currently has me thinking if we can maintain last year’s revenue, I will be happy, but 2024 is looking to remain flat,” he said.

One industry source pointed out that since the recession never hit as hard has expected, 2023 was a good year sales-wise. “The recession never hit as predicted. Interest rates leveled off but inflation jumped operating costs and squeezed margins on older jobs already booked,” they said. “However, 2023 was a surprisingly good year with strong sales in an active marketplace with high ‘crane-counts.’ For 2024, we are budgeting a decrease top and bottom line. Bid activity and street chatter suggests there will not be as much work out there, threatening sales, heightening competition and pressuring margins.”

Drew Roberts, CEO of Greenville. South Carolina-based ProSource Supply described the change in sales 2023 sales well, describing the year as a roller coaster. “The COVID years changed purchasing habits as people replaced items quicker than normal due to higher use or using spare time to renovate, impacting the demand cycle for several years. The dramatic increase in interest rates, the smoothing supply chain and considerable changes to commodity prices kept us on our toes all year,” he said. “2024 could be another roller coaster as we all get used to the new normal, anticipate the presidential election's outcome and see what changes the FED makes. Ultimately, we continue to hear moderate single-digit organic growth and feel that is probably accurate. Regardless of what happens in 2024, we remain excited about our industry, both the short-term and long-term outlook. We know America remains underbuilt residentially, and coupled with the recent on shoring efforts; we believe there are many reasons to remain bullish.”