Respondents to ASA’s Monthly Sales Report logged somewhat mixed results for the month of June. The median indicated a sales decline of -1% for June 2023 vs. June 2022, while the average remained in positive territory at 2% growth.

On a month-to-month basis (June vs. May 2023), respondents reported essentially flat sales (+0.1%). Year-to-date sales through Une 2023 increased 5% vs. 2022.

Additionally, on a trailing-12-month basis, respondents reported sales growth of 9%, with half the respondents reporting TTM sales growth between 4% and 15%.

Inventory remained relatively flat for June 2023 vs. June 2022, edging up 0.6%. The median three-month average days sales outstanding jumped from 39 days in May to 41 days in June.

"At the midway point of 2023, it’s encouraging to see Year-to-Date (YTD) sales growth at 5% and trailing twelve-month (TTM) sales growth at 9%. While June was essentially flat compared to May, it was down slightly (-1%) year-over-year. It may seem like a "broken record", but expense management continues to be extremely important in this environment of increased margin deterioration. For the fourth consecutive month, nearly half of the respondents reported a decrease in gross margin and profit before taxes YTD vs. a year ago." Industry Insights Senior Vice President Greg Manns said.

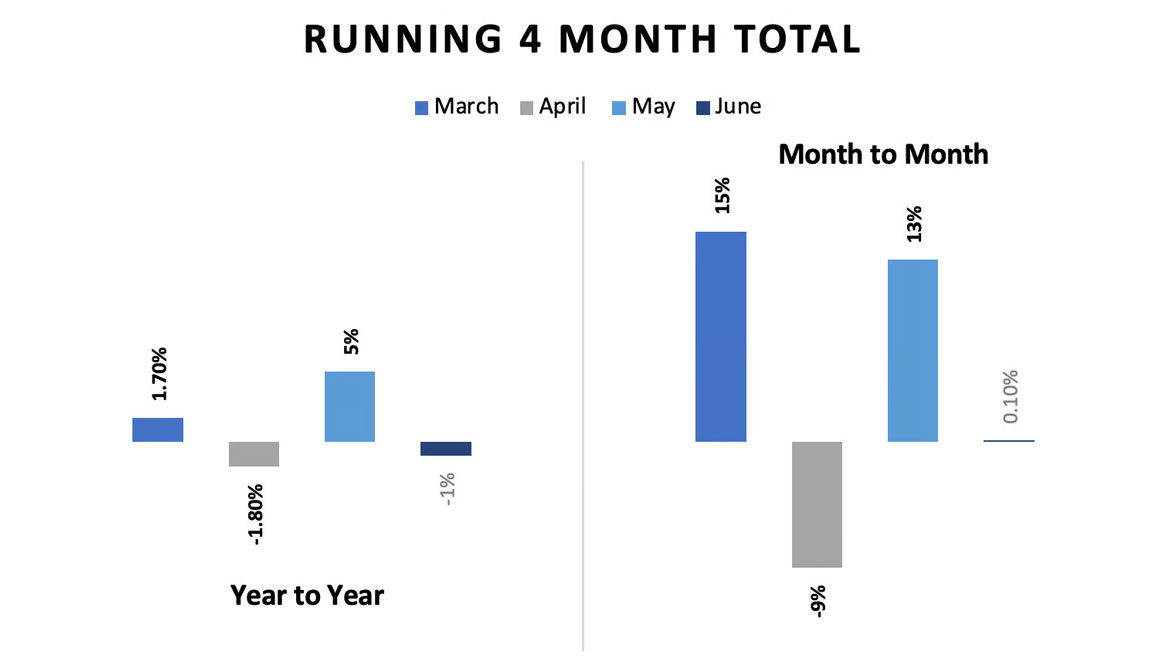

Here's a look at median sales totals for both year-over-year and month-to-month for the previous four months:

Industrial PVF:The news was positive for industrial PVF distributors. Respondents reported median sales growth of 5.7%. Comparing June 2023 to June 2022, PVF distributors reported median sales growth of 9.3%, while the trailing-12-month median clocked in at 14.2% growth.

Economic Indicators:The final "Real" GDP growth for the first quarter 2023 was revised up from 1.3% to 2.0%. Total wholesale sales for May contracted -4% year over year, while inventories grew nearly 4% vs. the prior year. The Department of Commerce recently began reporting "Real" wholesale sales to provide a more accurate picture of inflation adjusted growth.

In a sign that inflation is beginning to calm and that we are entering a disinflationary period, "Real" wholesale sales growth was +2% for May. After reporting unexpected increases in May, housing permits and stars both reported declines in June. Although, housing starts for June were still up 4.5% vs. June 2022. The unemployment rate decreased from 3.7% in May to 3.6% in June.

What ASA distributor members are saying:Some comments from ASA member distributors that participated in the June monthly sales report:

- "June was a tough month, but we do not know if it was weather related - we experienced significantly more rain than normal - or if it is the underlying market. Our customers continue to be bullish for the full year. We continue to experience significant pressure on margins as competition has increased and commodities have fallen dramatically."

- "Still just anticipating economic trends."

- "Upswing in the cooling side of the business due to very high temperatures. New construction market is somewhat stagnant for us."