Project supply is typically more complicated than MRO replenishment. In this particular arrangement, the entire buying process was turned over to R.J. Gallagher, which was more efficient in the procurement and storage of inventory. The engineering contractor issued the specifications to Gallagher, which in turn requested and collected bids. As in standard I/S arrangements, vendors who used to supply material directly to Union Carbide became second-tier suppliers and delivered the products to Gallagher.

After receiving the preliminary engineering design and specifications and vendor approval from Union Carbide, Gallagher's buyers immediately began procurement for items with long lead times. However, planning ahead doesn't always mean smooth sailing: As engineering design work progresses, many revisions are made, with resulting modifications in some specifications. A change in pipe routing, for example, necessitates changing the quantity of pipe needed.

In the event of such changes in design specifications, the product might have to be stored for a future project with the same customer or retooled for another customer. In this arrangement, retooling or return costs were passed on to Union Carbide.

Several times, Gallagher was asked to procure specialty items for aspects of the project that were subsequently put on hold. The items were specially designed for the project and could not, therefore, be sold to other customers. The associated holding costs fell on Gallagher's shoulders until the project progressed to the point that the items were needed.

Under the agreement with Union Carbide, Gallagher had to buy supplies from vendors listed in Union Carbide's approved manufacturers list. These AMLs often don't match up with the integrator's own preferred vendors. In fact, a particular branded item might be distributed by a competitor. In the bid process, that competitor has to give the integrator its prices.

This kind of information can be very valuable in pricing bids for future projects against the same competitor. (Of course, this situation works against the integrator when it has to supply information to a competitor acting as the integrator for another client.)

About that free lunch

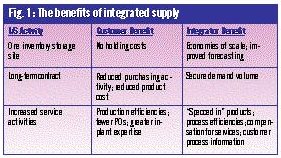

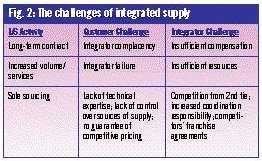

Integrated supply certainly offers benefits for both parties but also presents challenges. (See Figures 1 and 2.) Both parties must understand that service levels increase and margins shrink, so the integrator needs to be directly compensated for service. The integrator's in-plant operations lead to better processes for both parties. That benefit has a cost, however, since the integrator in effect sets up a satellite warehouse within the customer's facility.The integrator also faces the risk of underpricing its services. Because most distributors still give away services with the product, they don't have a good feel for what those services are worth. However, integrators need to know how much these services cost their firms. Otherwise, they have little information for pricing for those services.

In this case, Gallagher had no historical information about how much serving this customer would cost. Reductions in holding, procurement, material and process costs can be measured, but much of the information necessary for measurement is unknown at the outset. In a traditional marketplace, supply and demand would set the price, but in I/S no such efficient market exists.

Gallagher and Union Carbide were well aware that ignorance is far from bliss. They agreed to calculate the price of service using an activity-based system: The price of Gallagher's service was the same whether the product delivered was a handful of screws or a 200-lb. valve assembly. Gallagher managers worried about putting exact costing at risk, but the system worked well.

Integrated supply may be the most complex supply-chain-management arrangement in existence. The benefits are significant. But because the complexity of I/S is greater in a project environment, additional care should be taken on the part of the customer and the supplier in forming and managing the alliance. R.J. Gallagher and Union Carbide had done their homework, and the result was the best integrated-supply arrangement we have seen so far.