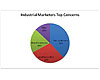

Figure 1. Industrial Marketers Top Concerns

Texas A&M’s Industrial Distribution Group states, “The distributor needs to develop more advanced and targeted market intelligence and spearhead an advanced rapid deployment to get the product to market.”

New rebate optimization tools and best practices are being developed to deliver real-time market intelligence that drives specific product purchases by end customers.

There’s an old joke in sales that after hibernation, everything looks like food. For home improvement products manufacturers, suppliers and contractors, business over the last seven years has been tough and everyone’s eagerly looking for the rebound in homeowner purchases.

Inc. Magazine reports recent residential construction is one of the “hottest high-margin industries.” Inc. forecasts an increase in spending of 63% to $303 billion annually by 2017. The opportunity for top-line growth and market share can’t be missed.

Aberdeen Group (industry research provider) reports 48% of manufacturers use rebates as a means to drive top-line revenue and build competitive advantage. From our discussions with home improvement suppliers, rebates are an integral part of their promotional mix and an enormous smart revenue growth opportunity if properly implemented.

But the benefits will only accrue to those suppliers who can effectively use rebates to harvest consumer information and market intelligence. If independent suppliers can’t get the job done, manufacturers will either rely on big-box retail or go back to manufacturer-owned distribution.

Given the intense grab for market share and margin growth over the next several years, it’s not surprising that 87% of industrial marketers cited one of these three issues as their primary goal (See Figure 1).

While Aberdeen Group’s survey results are not limited to the home improvement industry, the issues between manufacturers and “retail” is consistent.

One point to bear in mind is the distribution chain is not aligned. A retail contractor recently wrote in a LinkedIn discussion, “It is more important to have a good installation than the brand.” Suppliers have to make sure their product has a place at the table before the contractor and customer sit down.

The Aberdeen survey also reports that while rebates are a useful tool, the industry has shortcomings in its ability to execute rebate programs effectively.

In general, marketers cited these issues as major hurdles:

- Lack of promotional effectiveness

(32%);

- Competing business models between retailer and manufacturer

(26%);

- Inability to measure and predict due to poor execution (21%);

and

- Inability to use relevant customer data (21%).

- Let’s look at some best practices that address these problems.

Promotional effectiveness

This problem deals with a lack of visibility that occurs within a disintegrated demand chain. Manufacturers pass promotional funds to suppliers who then pass funds to contractors to influence consumer purchases. Information associated with reach and consumer acceptance is delayed or not gathered at all. Programs are extended or altered more in response to what competitors are doing vs. how consumers are engaging with offers.This issue is solved with a centralized database that captures consumer engagement from discovery to purchase. Currently, information is in too many hands and in too small quantities to be useful to anyone.

Competing business models

It’s assumed a contractor and a manufacturer are aligned when engaging the customer. That’s not true. While both want to capture a new customer, the contractor has a wide range of offers to serve the customer while the manufacturer needs a specific product purchase.The supplier needs to influence the consumer before the sales process. Targeted communications to specific consumers can get product information inserted at the right time.

Manufacturers/suppliers also need to think of combined offers that support different product and service agendas. Owens Corning has done a good job in creating insulation kits. The kit allows for combined insulation and air-sealing rebates, an increased service offering for the contractor and product pull-through for Owens Corning.

Inability to measure and predict

This is where finger-pointing comes into play. Suppliers have to know if the offer is competitive. Is the communication channel providing reach? Is it easy to sell to and easy to buy from? Is retail responding effectively or at all?Further, suppliers need to distinguish between retailers (contractors in the home improvement example) that can provide volume and growth. Often times, larger retailers try to improve operational effectiveness and profitability. Which retailers are focused on growth? Knowing this will impact how the supplier deploys promotional funds in support of revenue and product sales objectives.

Industrial marketers need to direct and track leads and monitor execution as a homeowner moves toward purchase. Do you know the conversion rates within the sales funnel for your products? To help figure it out, establish key performance indicators such as time to contact, time to proposal and time to close. Homeowners also need to be polled to understand if they were responded to in a timely manner and where exemplary service and lack of service was experienced. Knowing this will impact how you deploy promotional funds in support of revenue, product sales and customer service objectives.

Inability to use relevant customer data

For suppliers, what insight do you have into the ultimate customer? This requires you know your customer’s customer. Here are a couple examples where the manufacturer recognized the need to represent its product directly to consumers and learn from the process.In order to get smarter about its ultimate customer, Andersen Windows launched Replacement by Andersen retail stores. Andersen decided to split its markets by continuing to serve the pro market through building material suppliers and residential homeowners through Andersen franchise stores. Sales through Home Depot and Lowe’s provide bulk revenue. As a result of increasing homeowner touch points, Andersen is able to gather important homeowner information that feeds its customer understanding.

Volkswagen has chosen to stay with its existing retail structure through independent dealers. It has segmented consumers and targets those looking for an “environmentally friendly orientation.” The result was a record 2011 during a global recession.

Rebates are an excellent tool for many suppliers to establish why a consumer should care about its brand. The onus on suppliers is to centralize data, learn about their ultimate customer and relentlessly test offers to segmented audiences.

The competition isn’t sitting still. Those who can harness customer information will win and those that can’t will get consolidated.