They sold more. They grew more. They consolidated more. And they're expecting more of the same in 2000.

That's the message from respondents to this year's Premier 150 survey. They reported an average increase of 10.2% in their fiscal 1999, more than double the 4.2% increase in the U.S. gross domestic product for last year.

Before our very eyes

Has consolidation slowed down a little, or are we just getting used to it? The answer is probably a combination of both. Companies that were voracious for acquisitions a couple of years ago seem to have tempered their appetites somewhat. No. 1 Hughes Supply (Orlando, Fla.) is focusing more on e-commerce and internal processes than on acquisitions, President Stewart Hall told Supply House Times in a recent interview. (See Culture Changes, March 2000, page 52.) Watsco, too, has pulled back after a very aggressive couple of years.Nonetheless, several familiar names have disappeared from this year's Premier 150 list. Carrier Corp. added several more companies to its stable of company-owned distributors, including former Premier 150 institutions Automatic Equipment Sales of Richmond, Va. (No. 17 on last year¿s list) and Carleton-Stuart, West Caldwell, N.Y. (formerly No. 41). These acquisitions gave Carrier a dramatic entrance to the Premier 150, making its debut on the list at No. 5.

Other former Premier 150 firms that are gone this year include Familian Corp., which now operates under the Ferguson name. As last year's No. 8, Familian made a considerable contribution to Ferguson's sales volume for its last fiscal year. For that matter, so did Thrall Distribution (Loves Park, Ill.), which was No. 51 last year, and 10 smaller companies that are now part of Ferguson.

Other changes in this year's list include the addition of a new entity created by the merger in late 1999 of three familiar names. The combined resources of Piping & Equipment (Conyers, Ga.), The Bertsch Co. (Grand Rapids, Mich.), and Mutual Manufacturing & Supply (Cincinnati) are now USFlow. Ranked last year at Nos. 39, 49 and 58 respectively, their collective sales clout puts the new company at No. 16. Still on the list is the Florida-based Piping & Equipment Co., which was not part of the USFlow merger. Without the Georgia corporation's revenues, however, P&E has dropped to No. 130.

Also among the missing as a result of acquisitions are Weinstein Supply (Willow Grove, Pa.), bought by Hajoca; Plumbers Supply Co. (Salt Lake City), now part of Familian Northwest (Portland, Ore.); and R.J. Gallagher (Houston), bought by Tulsa, Okla.-based Red Man Pipe & Supply. Homan's Associates (Wilmington, Mass.) made its one and only appearance on the list last year before joining the Watsco fold.

It looks like another Premier 150 institution will be gone next year. According to industry sources, LCR-M, which was formed just a few years ago by the merger between Moore Supply and LCR, is now operating under the auspices of Hajoca Corp. This situation apparently is similar to the Ferguson-Familian arrangement: Companies sharing common ownership are eventually integrated by the parent.

Number crunching

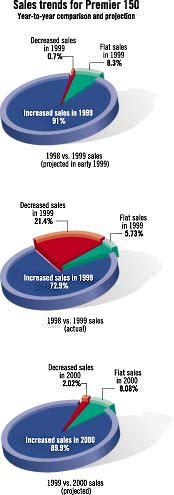

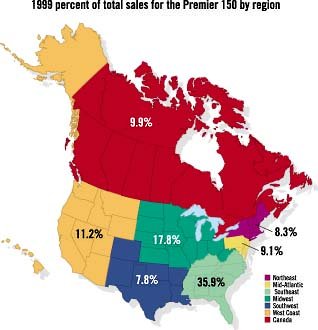

Few would dispute that 1999 was a good year for PHCP distributors, with the possible exception of companies that sell mostly industrial-PVF products. Nor would few be surprised. Last year, more than 90% of respondents anticipated an increase in sales volume for the year. It turned out, though, that some would be disappointed. Not quite three-quarters of the companies reported actual increases this year, leaving 17% to figure out where they went wrong. Our industry is apparently full of optimists, however, with 90% again predicting higher sales volume in 2000. From wholesalers' pens to God's ear ...The puzzling thing here is that despite the majority of wholesalers reporting increased sales and an estimated 4.8% growth rate for the PHC industry, the actual combined sales for the Premier 150 slipped 1.7%. We can't attribute it to smaller companies making the list as larger firms continue to consolidate, leaving room at the bottom. The cutoff point rises every year. In 1993, the lowest sales-volume category was $20 million to $29.999 million. Now it starts at $35 million.

So we turn to industrial-PVF distributors, the one group that tended to moan unhappily when asked, "How's biz?" last year. Sure enough, a disproportionate number reported flat or lower revenues compared with their counterparts in plumbing and HVACR.

More than one-fifth of this year's Premier 150 -- 32 companies -- moved up 10 slots or more on the list. The biggest gains were made by Northeastern Supply, Baltimore; Andrew Sheret Ltd., Victoria, B.C.; and Plumbing Distributors, Lawrenceville, Ga.

All this upward mobility allowed several new faces to join the list for the first time. Among them are:

- Bardon Supplies (Belleville, Ontario);

- Supply North Central (formerly D&C Supply of Ann Arbor, Mich.);

- Deacon Industrial (King of Prussia, Pa.);

- Dealers Supply Co. (Forest Park, Ga.);

- Riback Supply (Columbia, Mo.):

- Hirsch Pipe & Supply (Van Nuys, Calif.); and

- Cregger Co. (Columbia, S.C.).

Size does matter

There aren't many companies whose owners can routinely use the word billion when they talk about sales revenues, but this year's Premier 150 lists 13 companies reporting sales of half a billion or more. When the first Premier 150 appeared in 1993, only seven fell into that category, and one of them is no longer included for other reasons. (Supply House Times' editors decided to remove W.W. Grainger from the list when that company was unable or unwilling to break out its extensive product offering by PHCP category.) Another couple of firms are nearing the half-billion mark.Just how does that kind of revenue relate to the rest of the industry? For starters, the top 10 companies account for 47% of the sales volume for the entire Premier 150, and 22% of sales for all U.S. and Canadian PHCP wholesalers. By contrast, Nos. 11-20 represent 13.4% of Premier 150 sales and only 6.3% of the overall industry, while the remaining 130 of the Premier 150 provide 19.1% of the industry's total sales.

There's little reason to think the trend of the big getting bigger and the small getting bigger, too, will reverse anytime soon. In the first quarter of this year, additional announcements of mergers and acquisitions presage more movement in the 2001 Premier 150. One example is the January marriage of the Reardon Cos. (Attleboro, Mass.) and R.B. Corcoran (Hyannis, Mass.). By combining forces, these firms -- now Supply New England -- will make it onto the list next year ... assuming they don't get bumped by some other deal in the meantime.