The economic slowdown in 2001 may make next year's report less rosy, but for now let's enjoy one more joyous review.

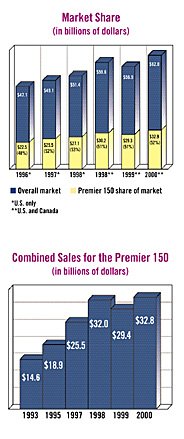

Respondents to this year's Premier 150 survey reported combined sales of $32.8 billion, an 8% increase from fiscal year 1999 figures. The typical sales change in the PHCP industry was 5.9%. However, nearly one-third of the companies reported growth of 10% or more, and only 7% reported any significant losses.

Consolidation is still a factor in the industry, although not as prevalent as it once was. While the big guys - Ferguson, Hughes and Watsco - have tempered their acquisition fever the last couple of years to concentrate on internal processes, others have jumped into the fray.

Carrier added another company to its stable of company-owned distributors, Shollmier Distributing Inc., No. 85 on last year's list. Some of our readers have expressed confusion as to why we include Carrier in the Premier 150 ranking but not Lennox, for example. Carrier breaks out its distribution numbers through Carrier Enterprises, its distribution arm. Lennox does not consider itself in the distribution business; therefore it doesn't break out its distribution figures.

Other no-shows on the list are Pioneer Metals Inc. (No. 43 last year) and No. 69 Herman Goldner Co. (bought by No. 93 Deacon Industrial Supply Co.). LCR-M Corp.'s (formerly No. 17) financials are now reported under Hajoca Corp., which jumped up one spot to No. 6.

Dealers Supply Co. Inc., No. 144 last year, dropped to No. 153. And Hammond Distributing Co., formerly No. 113, now does business as Goodman Midwest and dropped to No. 156. Goodman sold off 12 locations in 2000, which accounts for the lower figures.

Next year will see two more companies leave the list: Van Leeuwen Pipe and Tube, which was purchased by Wilson Industries earlier this year, and Climatic Corp., which was recently purchased by Carrier Corp.

New friends

Some new faces show up on this year's list, including one in the top five. Rexel S.A., a French company, acquired Westburne Inc. in fall 2000. Westburne now operates under the auspices of Rexel Canada Inc., and holds steady at No. 3.Another new name appears at No. 88 - American Refrigeration Supplies, which changed its name from Arizona Refrigeration Supplies to reflect its growing market.

The merging of Reardon Cos. and R.B. Corcoran resulted in the debut of Supply New England (headquartered in Attleboro, Mass.) at No. 132.

The rest of the newcomers are:

Another 15 companies jumped up 10 spots or more. The biggest jump was by Deacon Industrial Supply, which broke into the top 100 at No. 93 from last year's No. 144. This can be mostly attributable to Deacon's purchase of Herman Goldner.

To illustrate the fluidity of the Premier 150, and the industry itself, the first ranking in 1993 included 55 companies that do not appear on the 2001 list.

Those companies - representing more than 35% of that original list - have been bought out, beat out or pushed out by more vigorous companies.

For a breakdown of the best and brightest in the plumbing/hydronics, industrial PVF and HVACR sales categories, see the Segment Leaders listing.

By the numbers

This year's ranking has 14 companies selling a half a billion or more; seven of those companies sold over $1 billion last year.The top 10 companies accounted for 49.7% of the sales volume for the entire Premier 150, and 26% of all sales for all U.S. and Canadian PHCP firms. By contrast, Nos. 11-20 represented 13.6% of Premier 150 sales and only 7% of the overall industry, while the remaining 130 of the Premier 150 provided 19.3% of the industry's total sales.

With a good year behind them, our readers are optimistic about 2001 sales: 77.3% predict increased sales from 2000. Another 17.5% predict they'll have the same sales this year as they had last year. One can only hope.