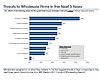

Wholesalers

weighed in on what they believe to be the biggest threats to their companies in

the next three years. Graphics are from BNP Media’s 2011 Future of Wholesaling

Report.

Confidence is rising among wholesalers in the PHCP industry.

In a recent survey conducted bySupply House Times, the American Supply Association and BNP Media’s Market Research Division , 66% of respondents say they expect their business to grow - with 16% saying their business will significantly grow - in the next three years. In contrast, only 2% forecast a decline in their business.

The survey, conducted in late August, seeks to identify information in four areas: expectations of business growth; impact of federal legislation on the wholesale industry; the Patient Protection Affordable Care Act and how it will affect staff size; and the importance of tax expenditures. A majority of respondents (53%) are either the owner or president of their wholesaling company.

Eighty-one percent of respondents believe growth will come from the commercial/industrial sector. The second biggest growth area will be residential business (52%) followed by the public sector (45%). Respondents mention renewable energy (22%) and other industries (5%) such as drilling, controls, Internet and repair as areas where they will see more business.

Despite their optimism, respondents perceive threats that could derail their growth. The economy poses the biggest threat, according to 86% of respondents. After that, federal legislation (55%), failure to address tax reform (48%), general lack of business (48%) and employer mandates (44%) are on the radar. Fluctuating commodity pricing (32%), pricing (28%) and local competitors (26%) are other threats.

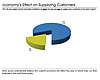

Most

survey participants believe the current economy will affect the way in which

they run their businesses in the next three years.

Factors Affecting Future Growth

Being there for clients is the most important factor to the future of the wholesale business. With five factors to select from in the survey, dependability leads the way with 71% saying it is very important. Quality is second (55% very important) and technical support comes in third (52% very important). Price finishes no higher than fourth (36% very important) followed by independent sales organizations (19% very important).The importance of supply houses should remain level, according to the survey. Forty-six percent of respondents say their importance will stay where it is today, while 41% say the importance of supply houses will increase in the next three years.

Some respondents disagree. When asked for specifics on why the traditional supply chain model is not relevant, their responses vary.

“I find locally all the ‘traditional suppliers’ are locking up manufacturers and selling direct to end users and cutting out the smaller retailers,” one respondent states.

Another adds: “Manufacturers started walking both sides of the wholesale/retail street; reps are now doing the same. Now, the trade is starting to do this also.”

Still another notes: “The Internet has opened up several different methods for vendors and manufacturers to directly and efficiently communicate. If embraced, it can lower many costs.”

Despite these comments, respondents overall do not anticipate a major shakeup in the traditional supply chain model. Forty-three percent say the traditional model will stay very relevant to business while another 40% believe the model will stay relevant. Only 3% say it will not be very relevant and 1% say it will not be relevant at all.

The survey asks wholesalers to explain how current economic conditions will affect the way they plan to supply customers over the next three years. Respondents’ comments focus on smaller inventories:

Sixty-five percent of wholesalers believe federal legislators will

have a negative impact on the future of the industry.

Federal Legislation Impact

While 24% of respondents say they don’t know what impact federal laws will have, only 2% believe it will be positive. Sixty-five percent of respondents say wholesalers will feel a negative impact from action by the federal government.“More regulations and fees will become more common,” one respondent says. “Government is too big and will over-regulate our industry.”

Another notes: “I can’t imagine how legislators could possibly have a positive impact. Most of their actions are a result of some occurrence, with minimal understanding of the long-term impact of new legislation.”

The survey asks why wholesalers believe federal legislators will have a negative impact on the future of the wholesale industry. The comments include:

Government can be a force for good, according to a handful of respondents. One says: “They will hopefully pass a law to allow HVAC wholesalers only to be able to sell to licensed HVAC contractors. Keep raising ‘higher’ laws. It may cost more up front, but will save more over the 10- to 15-year life of a unit.”

Various

sources are mentioned as to where survey respondents gather industry-specific

information. Note: Both industry publications and direct customers are seen as

equal sources.

Effect of Health-Care Law

The passage of the Patient Protection Affordable Care Act is a hot-button issue among wholesalers, but here is a good sign for employees and wholesalers alike: 66% of respondents say they don’t expect to downsize their current staffs in order to operate below employer mandate thresholds.The PPACA says starting Jan. 1, 2014, that if a company employees 50 full-time workers and doesn’t provide health care it will face a $2,000 per employee tax penalty.

In the survey, few respondents express support for the PPACA. Among their comments are:

Critical Tax Expenditures

Congress created a super-committee to find $1.2 trillion in cuts of federal spending by Nov. 23 after the debt ceiling crisis during the summer. Wholesalers are keeping an eye on what the committee will come up with.The survey asks wholesalers, assuming the government increases revenue along with reducing expenditures, what tax expenditures would be most critical to their business. They are:

LIFO (short for “last in, first out”) is an inventory accounting method used by companies to determine both book income and tax liability. Staff reductions may happen, according to the survey, if LIFO is repealed and wholesalers are required to pay the LIFO reserve.

Thirty-nine percent of respondents say they would reduce staff, but 21% say they wouldn’t take any action because they don’t anticipate a larger tax hit.

Eighteen percent say they would take other measures such as freeze wages or scale back their growth plans.

Maintaining interest deduction is the most essential tax deduction to maintain, according to 69% of responding wholesalers. The repeal of the estate tax (19%) and the manufacturer’s tax credit (6%) and accelerated depreciation for showrooms (6%) also register with respondents.

When asked what the single greatest threat to the business will be, 51% of respondents said the economy was the biggest. General lack of business (15%), federal legislation (13%) and failure to address tax reform (9%) followed.

Information Sources

Other questions in the survey ask respondents about their information sources and demographics. Wholesalers get information about their industry in many different ways, but industry publications (79%) and customers (78%) are their favorite sources. Suppliers (68%) and non-industry publications (45%) lead social media (19%) and external consultants (18%) as other sources of information.Twenty-seven percent of respondents say they are an owner of a wholesale firm, followed by 26% saying they are a president and 21% saying they are a branch manager.

General manager (17%), vice president (7%) and chairman (2%) round out the job titles.

Forty-nine percent say they are between the ages of 55 and 64; 29% are 45 to 54; 10% are 35 to 44; 8% are 65 or older; 4% are 18 to 34.

By region, wholesalers in the South and Midwest comprise the biggest survey participants, with 30% responding in each. The Northeast and West each make up 20% of respondents.

Thirty-eight percent of responding wholesalers say their estimated 2011 revenue would be between $10 million and $50 million. Next are companies with revenue between $1 million and $10 million (32%); $50 million to $100 million (11%); $1 million or less (11%); and $100 million or more (9%).

Forty-one percent have 25 employees or less. Next are companies with 26 to 50 employees (21%); 51 to 100 (18%); 101 to 250 (15%); and more than 250 (6%).