It's almost the classic case of marrying the kid next door. For years, two companies - Wilson Supply and Texas Mill Supply, both of metropolitan Houston - had been thrown together both by geographic proximity and by common interests.

Gradually they came to realize that they should take advantage of the relationship that has developed between them. The resulting merger - specifically the acquisition of Texas Mill by Wilson - allows both organizations to function more effectively.

While this new relationship is admittedly still in the honeymoon phase (it was final in mid-January), both parties are happy. Mill, safety and janitorial supply is relatively new territory for Wilson, but the company is confident it has chosen the perfect partner. A longtime powerhouse in upstream energy supplies, Wilson entered the industrial market (primarily refining, chemical and pulp and paper) with its acquisition of Tyler Dawson in 1991 and Wallace Co. in 1993. Then in 1998, Wilson was bought by Smith International, a $2-billion manufacturer and supplier of products and services for oil and gas exploration, development and production worldwide.

In fact, a key attraction Wilson held for Smith was its industrial customer base, says John Kennedy, president of Wilson and former chief financial officer for Smith. He explains that Smith is in the supply-chain-management business moving products around the world. And the company was looking for a better way to do that through technology, which had served it well in its primary fields: metallurgy, chemistry and manufacturing.

"But oil-field distribution lacks technology," Kennedy says. "There are many old-style businesses involved that lack capital to invest in technology. Smith believed that by supplying the capital, it could substantially improve supply-chain management."

The next logical step was to move into industrial-mill supplies. "We wanted to broaden our customer base and the product offering for our existing customers," Kennedy says. "The other attractive thing about Texas Mill was its service capability, particularly on the integrated-solutions side. Wilson was doing some, but not on the same scale as Texas Mill. We could apply that to our own customers. It was the next step in our industrial strategy."

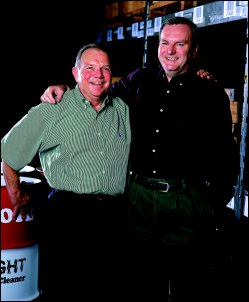

With the acquisition, Wilson gained access to the expertise of its employees - particularly its president, Monte Legro. A former corporate attorney, Legro was "persuaded" to come back to the family business for a six-month stint when his father retired. Those six months have stretched into two decades. And what a ride it has been.

"In the last 15 years, our customers' approach to the marketplace has really changed a lot of things," Legro points out. "It used to be that local suppliers were good enough. Later, if you weren't regional, you weren't a player. Then it was national."

Thinking globally

This increasing scope made Legro start thinking about ways to deal with a national market. The bulk of Texas Mill's business is with heavy process industries, such as petrochemical, refinery, pulp and paper and public utilities. The firm's typical customers are "very large companies with very large plants," Legro says. Texas Mill already had 20 locations, but he was looking for better national coverage."The ability to achieve greater scale by combining with another, similar company is very attractive to a distribution company," he says. "Our customers operate on a worldwide scale, or at least on a national scale. The capital requirements and ability to provide more products, take out costs and bring more value to the supply chain makes the combination of similar businesses with common customers very attractive to all of us."

Kennedy agrees. He and other Wilson managers recognized three major challenges before them: globalization with customers looking for suppliers that could provide their needs on a global basis; consolidation as customers grew and wanted to consolidate their vendor bases; and technology.

"These factors are all interrelated," Kennedy says. "Technology advances allow companies to look at their business on a global basis, and it accelerates a lot of the consolidations we are seeing. And the Internet is changing the nature of supply-chain management. So we felt it was a very appropriate time to broaden our presence in the industrial business."

Wilson and Texas Mill frequently found themselves working for the same customer and soon discovered they had much more in common than dispatching trucks to the same address. Legro recalls his surprise at the realization how similar the two firms are.

"The amazing thing to us were the common philosophies and the approach to the market," he says. "We're both pretty progressive. For example, we were in the process of implementing Oracle databases Wilson already had. We were both trying to bring the most value to our customers while still being good business people. The cultural fit was wonderful."

Kennedy also appreciates the opportunity for each company to build on the strengths of the other. "One thing we recognized is that people are the key in supply-chain management. We recognized that Texas Mill had first-rate people, particularly in areas such as customer service, where we really wanted to focus."

The human touch in e-commerce

Legro believes a big part of that remarkable customer service was the evolving role of Texas Mill's outside salespeople, an evolution sparked by new systems within customers' own procurement procedures."Technology changes in our customers' businesses drove changes for us," Legro says. "These days, our outside salesmen never take orders. They are account managers and problem solvers. They connect the manufacturers representatives to the manufacturer's direct-sales people. They get the experts to customers who need them."

Like Wilson, Texas Mill was looking to broaden its product and service offerings, Legro adds.

"We try to respond to what our customers need, not tell them what they need," he says."We've expanded into the safety business, paper goods and quite a few services. As customers increased outsourcing, we were able to pick up a lot of that business. We manage several storerooms for our customers; we provide purchasing services on-site and off-site. We do electronic communication and run parallel systems. Joining forces with Wilson was really just another way to give our customers more value."

As a result of the expanded role of outside salespeople beyond order taking and of the efforts to provide new services, Texas Mill started moving toward electronic data interchange 15 years ago. In fact, about two-thirds of the company's business in recent years has been through EDI or systems linkage. Despite this technologically advanced approach at his own company, Legro was especially intrigued by Wilson's e-business initiative.

"The system they were testing was not just a 'me, too,'" he says. "It was a state-of-the-art B2B portal with all the capabilities of some of the most impressive dot.coms. Combining these capabilities with the Web-enabled Oracle applications and Sterling Commerce-based EDI functions gave us opportunities for service offerings that were almost overwhelming."

Because the increased use of technology is reducing the need for human assistance in e-commerce, employees will be able to shift their attentions directly to the customer instead of a keyboard, Kennedy says. "That's the real benefit of electronic business. As the company grows, you don't have to add people at the same rate as you would have historically."

One big happy family

The union of Wilson Industries and Texas Mill Supply also delighted their customers, say Kennedy and Legro. "In many cases, we are the sole supplier to the customer,"Legro explains. "This acquisition gives them the chance to do more with less."Both Kennedy and Legro are pleased with how smoothly the integration of Texas Mill Supply into Wilson has gone. Legro has no doubts that selling his company to Wilson was the right thing to do.

"As a private enterprise, we had an obligation of stewardship to all the people who helped build the company and to all the associates," he says. "But this was such a good fit that it was exciting for all of us."

Corporate Profile: Wilson, a business unit of Smith International, Inc.

Locations:Headquartered in Houston. 120 branches in 14 states; almost 40 branches in Canada with C.E Franklin. In addition, manages inventory on-site at more than 60 customer facilities.Annual sales:$497 million; first quarter 2000, $218 million

Employees:1,900

Markets:Energy and industrial.

Management team:John Kennedy, president; Lynn Perrin, vice president/operations; Charlie Tresselt, vice president/finance; Mark Chellis, vice president/e-business and marketing; Monte Legro, vice president/industrial; Kirk Long, vice president/industrial sales; Scott DuBois, vice president/energy; Boyd Noble, vice president/integrated solutions; Tom Conley, vice president/branch operations; Bill Herrington, vice president/branch operations.

Products and services:Pipe, valves, fittings; mill, safety and janitorial products. Integrated solutions including vendor, warehouse and inventory management.