Are the CEOs and sales managers from vendor and distributor firms in the plumbing distribution channel on the same page when it comes to evaluating the sales and marketing activities employed by their firms? We set out to answer this question in a recent study and found that not only are they not on the same page, they are not in the same book.

Table 1: Distribution of Respondents

Background & Methodology

In a previous study, we surveyed 2,100 firms (1,050 vendors and 1,050 distributors) to develop a scale containing 16 item statements to identify the value activities that can create a competitive advantage, which were:- 1. Vendor Relationships;

2. Customer Relationships;

3. Competitor Analysis;

4. Competitor Identification;

5. Top Management Activities.

The vendor and distributor firms were members of the following trade associations: Associated Equipment Distributors, American Supply Machinery and Manufacturers Association,American Supply Association, Equipment Manufacturers Institute, Industrial Distribution Association, National Association of Manufacturers, National Association of Electrical Distributors, North American Wholesale Lumber Dealers Association, North American Building Materials Distributors Association, and National Electronics Distribution Association.

In a new study, we used the previously developed 16 item statements to develop a research questionnaire and randomly selected a sample of 360 vendor and 360 distributor firms from our original 2,100 firms. The research questionnaire was designed to measure the importance of the five value activities - Vendor Relationships, Customer Relationships, Competitor Analysis, Competitor Identification and Top Management Activities - in creating a competitive advantage. We e-mailed the research questionnaire to each CEO and sales manager of the 360 vendor and 360 distributor firms in our sample.

These firms were from five industrial distribution sectors - electronics, electrical, plumbing, building materials, and associated equipment. Responses were measured using a five-point scale, in which 5 = most important and 1 = least important. To be included in the study, both the firm’s CEO and sales manager had to respond. For example, if only the CEO from firm “A” responded and only the sales manager from firm “B” responded, neither firm “A” nor firm “B” was included in the study.

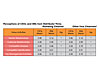

Table 2: Perceptions of CEOs and SMs from Vendor Firms

Results

As indicated inTable 1, respondents included 252 firms (119 vendors and 133 distributors) and 504 CEOs and sales managers for a response rate of 35%. Professors Charles Johnson of Oklahoma State University and Ronald Cohen of St. John’s University report that response rates greater than 20% from e-mail questionnaires are considered to be very good. Furthermore, our statistical analysis indicated that our 252 firm responses were equivalent to a response rate of 2,000 firms.Table 2shows how CEOs and sales managers from vendor and distributor firms in the plumbing distribution channel ranked the importance of the five value activities -Vendor Relationships, Customer Relationships, Competitor Analysis, Competitor Identification and Top Management Activities. We employed the appropriate statistical analysis and determined that our findings indicated validity and reliability. We used a confidence level of 95% to determine the statistical significance of the respondent’s perceptions.

An asterisk [*] in the column “Sig” in Table 2 indicates that the respondent’s perceptions are significantly different, while a blank space in the “Sig” column signifies that there is no significant difference in the respondent’s perception.

In the first section of Table 2, the perceptions of CEOs and sales managers from the responding plumbing vendor firms are presented. A significant difference existed in the perceptions of the importance of four of the five value activities - Vendor Relationships, Customer Relationships, Competitor Analysis, and Top Management Activities. We found no significant difference in the importance of Competitor Identification between CEOs and sales managers.

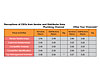

Table 2: Perceptions of CEOs and SMs from Distributor Firms

The third section of Table 2 illustrates the perceptions of CEOs from plumbing vendor firms and plumbing distributor firms. We found that vendor CEOs have a different perspective regarding the importance of Top Management Activities than do distributor CEOs. We found no significant difference in the importance of Vendor Relationships, Customer Relationships, Competitor Analysis and Competitor Identification between CEOs of plumbing vendor and distributor firms.

The fourth section of Table 2, describing the perceptions of sales managers from plumbing vendor firms and plumbing distributor firms, found no significant difference in the importance of Vendor Relationships, Customer Relationships, Competitor Analysis, Competitor Identification, and Top Management Activities.

Responding CEOs from both vendor and distributor firms ranked Vendor Relationships (means of 3.96 and 3.98, respectively) as being the most important value activity while sales managers from both plumbing vendor and distributor firms ranked Customer Relationships (means of 3.90 and 3.98, respectively) as being the most important value activity.

Responding CEOs and sales managers from both vendor and distributor firms ranked Competitor Identification as being the least important value activity.

Finally, in each of the preceding sections, responses from CEOs and sales managers from the other four industrial distribution channels are presented. We found that an average of responses from CEOs and sales managers of the other four channels were very similar to those responses from CEOs and sales managers from the plumbing channel, with the exception that vendor firm CEOs and distributor firm CEOs from the other four channels do not have a different perspective regarding the importance of Top Management Activities.

Table 2: Perceptions of CEOs from Vendor and Distribution Firms

Discussion

At the outset, we asked “Are the CEOs and sales managers from vendor and distributor firms in the plumbing channel on the same page regarding the importance of different value activities employed by their firms?”Our findings indicate that CEOs from both vendor and distributor firms are in agreement on the importance of four of the five value activities and that sales managers from both vendor and distributor firms are also on the same page (no difference in their perceptions of the importance of the five value activities). However, we argue that CEOs and sales managers from vendor and distributor firms in the plumbing distribution channel are not only not on the same page, but they are not in the same book.

We found statistically significant differences between the responses of CEOs and sales managers in both vendor and distributor firms in the plumbing channel in their perception of the importance of four of the five value activities used in the study. The four value activities that showed differing responses were: Vendor Relationships, Customer Relationships, Competitor Analysis, and Top Management activities.

On the surface, the difference in perceptions between CEOs and sales managers in both plumbing vendor and distributor firms regarding the importance of value activities may make it difficult for plumbing vendor and distributor firms in our study to achieve a competitive advantage. However, we should consider other factors. For instance, the perceptions of plumbing CEOs and sales managers may differ because of the nature of their positions: a CEO may adopt a strategic view of a situation while a sales manager may adopt a tactical view.

Perceptions of SMs from Vendor and Distributor Firms

Turning to our study, it is difficult to determine how a difference in perception affects a firm’s financial performance. Numerous studies have found that a difference in perception among CEOs and their top management team tends to lower performance. Certainly, in our study, many of the sales managers are not members of the top management team. Perhaps the secret is to somehow have CEOs and sales managers work together in the right way so that their objectives are aligned and focused on achieving a competitive advantage for their respective firm. Such an alignment and teamwork can flow all the way to front-line customer facing employees.

Or as legendary football coach Vince Lombardi said, “Talent wins games, but teamwork wins championships.”