“He studied to be a scientist, and that's the way he approaches business. He thinks about everybody's job and how to get the most out of that job function.”

This was how a top manager at Torrington Supply Co., Waterbury, CT, described his boss, and it's a keen assessment. CEO Joel Becker runs a company in which every job entails performance measurements and gets incentivized accordingly. At Torrington, even warehouse order pickers are able to earn extra income by exceeding performance goals.

Becker's scientific approach reflects a graduate degree in physics and a brief stint pursuing a Ph.D. in cellular biology before dropping out to work in the plumbing supply business. Here's how he explains that decision: “I learned quickly that the people in that field were really, really smart. People like me were mostly hard workers, and I'd have to work a lot harder to compete with them.

It's all relative. The average person would never detect a shortcoming in this guy's cranium, but I suppose hanging around Albert Einstein made some of the world's brainiest people feel inferior. The hard-working part of his statement sure rings true.

Becker's computer appointments calendar screams with multi-colored hues streaking across every day, of every week. It testifies to a schedule that includes service on four corporate boards of directors in addition to Torrington's and ASA's. He chairs the board of Waterbury (CT) Hospital, a public facility that is the city's biggest. He's on the executive committee and chairs the compensation committee of Webster Bank, Connecticut's largest, and also serves as a director of a lumber supply company and a chemical firm. In his spare time, Becker does a lot of fundraising for the local United Way - now chaired by wife Nancy, who took Becker's place.

Oh, and although he has stopped running marathons, Becker stills competes in dozens of half-marathons, 10k and 20k races every year. He runs, swims and/or bikes for a couple of hours every day. His lunch break typically consists of more than a mile-long swim. Plus, he reads a lot - business books, novels and history in particular.

Becker is what psychologists refer to as the quintessential “Type A” personality - extroverted, energetic, always on the go. Given his peripatetic activities, I asked Becker how he'll manage to fulfill the time commitments of the ASA presidency.

“This company has a very good management team,” he replied. “I have virtually no day-to-day management responsibilities. I realized long ago that the best contribution I could make to maximize the value of our business was to make it run without me. When I go away for a week, it seems that's the best week we have!”

“I've learned a lot from serving on all those other boards,” Becker added. “I hope to apply some of what I've learned to ASA.”

Torrington Supply was selected as SUPPLY HOUSE TIMES' Wholesaler of the Year in 1999. That served as the launch pad for our interview.

SUPPLY HOUSE TIMES: Please bring us up to speed on how your company has evolved since you were named Wholesaler of the Year in 1999.

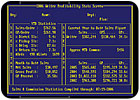

Becker:In some ways the company has changed dramatically and in others it is very much the same. Since 1999, we've grown by more than 70% and gone from about 80 people to 120 and from four to nine branches. Yet we still use a hub-and-spoke distribution model and still rely heavily on technology to drive our operation. As it was then, all our shipping and routing is controlled by our computer, but now with well over twice the transaction volume.In the latter half of the 1990s, we were focused on our internal systems. We worked on containing and understanding our operating costs, implementing activity-based costing systems to gauge customer profitability and direct allocation of services.

In the 2000s, we've become much more externally focused, working on growth. It has been an interesting transition going from a company solely focused on cost accounting to trying to balance what our ABC analyses tell us with our sales objectives. It has been gratifying to see how well our systems and people have handled the increased workload.

SUPPLY HOUSE TIMES: Give us a status report on ASA as you perceive its main issues.

Becker:I am very bullish about ASA and our prospects. I know we have some very significant challenges ahead of us, but I am convinced we have the will and the resources to maintain our preeminent role as the leading organization of the PHCP industry.

The good news is that ASA has a dedicated staff, strong volunteer leadership and the resources of the Education Foundation.

We have not effectively demonstrated our value in the supply chain. The profile of our membership has changed and we now have fewer larger distributors. That's because in the past our services targeted smaller distributors, and some of our programs are no longer of value to the large national or regional companies. We have some program restructuring to do here.

Yet, with all the changes, we still have a very important role to play and intend to be a valued resource. Our first task will be to keep our existing members involved and active. The good news is that most of our membership decline has been a result of member-to-member acquisitions. The actual number of branches has not changed all that much in the last 10 years. If we can successfully engage these companies, we'll naturally bring in new members. We can do this by delivering 21st century programs and services that are valued by everyone.

Our second membership step will be to reach out to the very large pool of unaffiliated independent wholesalers. In my own market I have an equal number of competitors that are not ASA members as are.

The ISH North America show is going to continue to be a challenge and probably is in need of some kind of change. With that said, it is still well attended and the most efficient way for contractors, distributors, manufacturers and reps to meet.

The key to raising manufacturer interest in the show is distributor attendance. We are going to work hard to build the attendance and make the show a valuable showplace for our manufacturers.

I feel strongly that there will always be a need and desire for an annual industry get-together, so our convention performs a very valuable function. There are surely changes we can make in the programming, but overall it's been pretty good. Every year I attend the Young Executives' “Meet the Pros” workshops and listen in amazement at what others have done in their showrooms, sales management, personnel management, etc. Where else are we going to be able to hear from the best in a constructive non-competitive format?

Most of what I've learned and done in my career has come from an idea sparked at an ASA convention workshop or social gathering. The buying group meetings are no substitute for these programs and serve a very different purpose.

SUPPLY HOUSE TIMES: Aside from ASA, what do you see as the PHCP distribution industry's biggest challenges, and how can ASA help distributors surmount them?

Becker:I was at a monthly staff meeting last week, and as we usually do, we went around the room asking the managers about their current “challenges.” Ten of the 12 managers' primary challenge had to do with personnel. And that is true month after month in almost every company.The greatest challenge we are facing is maximizing the value of our people, and it will become more acute over time. The number one business book of recent time, Jim Collins' “Good to Great,” has one message: Get the right people in the right positions, and everything pretty much takes care of itself after that. We all struggle with that.

In most companies, personnel costs are 50-60% of the gross profit and becoming more complicated. For instance, in an effort to control health care costs, we put in a high-deductible HSA health plan in January. Our HR manager spent essentially all of January, February and March dealing with our employees and their spouses on insurance reimbursement issues, as well as everything else she does.

The best companies put enormous resources into maximizing personnel productivity because it both pays off now and ensures a prosperous future. Most of the PHCP distributors I know of struggle with personnel issues and have not begun to figure out ways to maximize personnel productivity.

This is an area where ASA can make an impact. ASA has the resources and talent. We just need to decide to do it.

SUPPLY HOUSE TIMES: What will be your top priorities as ASA president?

Becker:The most pressing issue facing ASA is demonstrating our value in a way that will cause our existing members to feel their dues are a bargain and get new companies to want to join.This has been the top priority since I've been involved with ASA, so this is nothing new. However, I hope that we can build on the experiences of my predecessors and make some breakthroughs this year.

As our 2006 convention approaches, we are in the final stages of completing the original $10 million endowment campaign for our Education Foundation. The donors do not want the ASAEF to grow. They intended that the annual endowment income be spent developing and delivering programs to the ASA membership. It is now time to deliver the goods.

I have been a member of the ASAEF board for the last several years. We have worked hard at developing great training programs with seemingly broad appeal to our membership, but with limited success. I would guess less than 25% of all member firms purchase ASA training materials.

I hope ASA can work with the Education Foundation to redefine our value and expand our role. By limiting our scope to training, we've limited our opportunities and value to our members. Perhaps if we broadened our scope to include all topics involving personnel management and productivity, we could have a larger appeal and attract the interest of all members.

SUPPLY HOUSE TIMES: What issues do you anticipate spending most of your time dealing with?

Becker:I hope not to have to spend much time dealing with regional affiliate differences or anything else that distracts us from our real task.The convention and trade show is always an important issue on the agenda. The annual convention and ISH NA or tabletop show are the highlight and the culmination of our work for the year. It is here where we get to show off our programs and bring our membership together. It is also a venue to hear from our membership, which I hope to take advantage of next year.

But the primary focus of my time will be to develop a value strategy that will appeal to every membership segment - local and national, distributor, manufacturer and rep -and not compete for membership time with the buying groups.

SUPPLY HOUSE TIMES: Discuss your implementation of computer technology into your business, and how you perceive it in the industry as a whole.

Becker:You know that we've been something of the poster child for technology integration into our everyday lives at Torrington Supply. We decided long ago that if the process was repeatable and predictable, we would try to figure out a way to have the computer do it for us.

In the late '90s, we began to analyze our sales transaction data to determine individual customer profitability, and developed an online interactive activity-based costing system that our sales and customer service personnel use to make sales and service decisions. More recently we've integrated our customer profile and profitability data into our outside sales call reporting system and commission plans.

In addition, we do EDI with most of our major vendors and have a real-time XML relationship with one of our larger online customers. We have developed a culture whereby we always look for an automated solution for everything repetitive we do

Computer technology has taken off here, but it's only going to take off with other distributors if it makes financial sense. The advantages are enormous to do what we do, but it's expensive and requires a lot of resources, work, ambition and tenacity.

Computer technology allows us to do more with the same number of people, not to do the same with fewer people. Most of us in this industry are not coldhearted and looking to eliminate people. That means the payback is questionable unless you're growing rapidly.

SUPPLY HOUSE TIMES: What's going on with ASA's Center for Advancing Technology?

Becker:When the Industry Data Base product was introduced, we saw this as a godsend and in concept it is. But the devil is in the details and we were never able to make it work effectively for us. Most distributors see technology as an inherent part of their operations. To some it's a competitive advantage, and they don't want their trade association to level the playing field.

Over the last couple of years, CAT has moved away from product development, such as Source ASA and IDB, and focused more on finding third-party products of use to the membership. We use ASA ANSINET, the EDI product, and have recently signed up for HomePortfolio.com. We have seriously looked at Catalog Builder, and at some point, will probably take on that product as well.

In a way I am saying that CAT has provided real value to a limited number of members. The problem has been CAT's services have not had a broad appeal.

SUPPLY HOUSE TIMES: The industry has been riding the wave of a strong economy for several years. How long do you think it will last? How can or should distributors react if the good times come to an end?

Becker:I am not an economist and do not have any better insight into the future than anyone else, so I will not venture a guess on what the future holds.The 2005 ASA Operating Performance Report shows that the average participating distributor had a net profit of 2.8% of sales. That is not a lot of room to spare. Most distributors have lived with tight profits all their careers and have learned to run lean organizations. I do not suspect there are many that have survived over the years that have been lulled into frivolous or extravagant spending during these good times.

I know in our case we have two or three people more than we might otherwise have in anticipation of continued strong growth, but that is all. If there were a turn in the economy we could right-size quickly with little pain to anyone. I suspect most distributors are in the same state.

Joel Becker's Industry Background

Joel Becker entered Torrington Supply - wife Nancy's family business - in 1975 after attending three years of graduate school in physics and cellular biology. His training followed the familiar scenario of learning operations by working in the warehouse, later moving to the sales counter. In 1980, he was made co-sales manager with brother-in-law and subsequent partner Fred Stein. In 1986, he was named general manager in charge of operations and the computer (SHIMS). In 1990, Becker became co-CEO, whereby Stein was responsible for the sales, and Becker the operations and finance. This arrangement stood until Stein's retirement last December.Becker's father-in-law, Morris Stein, was an ardent ASA supporter and built his career around the concept of participation and giving. At his urging, Becker began attending regional monthly credit meetings when he was still working in the warehouse.

“There was a real purpose and camaraderie to those meetings,” Becker recalls. “I got to rub elbows with all the owners of our competitors and got to know them pretty well. My father-in-law always told me to treat our competitors like customers.”

Becker began attending the regional and national conventions in the late 1970s. In the early 1990s, he was asked to fill a vacancy on the IPD Council and began attending ASA board meetings. During that time, he frequently volunteered for non-IPD assignments and was involved on the Technology Committee and then CAT. In the 2000s, he served on the ASAEF board, and since 2001 has been on the ASA Executive Committee.

Torrington's Version Of Family Planning

Torrington Supply Co. was named 2005 University of Connecticut Business School's Family Business of the Year (large company category), thanks to a number of excellent family business practices employed by the company. They include:

Torrington shares financial and budget information with all employees, not just family members. “We not only share it, I encourage our people to look at it every day,” commented CEO Joel Becker. The company hosts three meetings a year to discuss operations and performance with all employees. Attendance is voluntary, but about half of the employees attend.

The company's five-person board includes three outside directors, who are paid for their services. According to Becker, the outsiders were selected for specific expertise. One is involved in real estate, one in distribution in the chemical industry and the third is from the financial field.

The company insists that all family members who work in the business have a college degree and must work in another company for at least one year before joining Torrington.

Family members get paid the same scale as anyone else would for performing the same job. Those with ownership positions may receive extra compensation in the form of dividends, but not larger paychecks.

Torrington's family plan is separate from the company's business plan. It is a six-page document that spells out for succeeding generations not so much what to do, but emphasizes their role as shepherds of a business trust. Assets will be passed on to heirs but not necessarily company management. The family business plan includes a provision for hiring an outsider to run the company if it's determined that an heir lacks suitable qualities.

Nancy and Joel Becker have one daughter, Emily, working in the business, as well as son-in-law Chris Fasano. They have high hopes for the company continuing as a family-owned independent, but are realistic in providing for other contingencies.