The agreement announced Dec. 13 certainly caused a lot of distributors to sit up and take notice. Ditto for Wall Street: Dec. 14 marked the 52-week high for The Home Depot's stock. By the end of that week, Home Depot had displaced Coca-Cola as Georgia's most valuable company. Apparently industry analysts think that the deal will be as successful for Depot as plumbing wholesalers fear.

A long courtship

Discussions about The Home Depot's possible acquisition of Apex Supply actually began "a while back, but nothing came of it before," reported Clyde Rodbell, chairman of Apex Supply. "They weren't sure what direction they wanted to go. They wanted to be more heavily involved in the professional contractor business, and they recognized that it would be difficult or impossible to do that in their current situation. They understand that if they want to reach the professional, they have to do it through professional sources."Rodbell emphasized that he and President Sidney Rodbell -- both have multiyear contracts to stay with Apex -- will continue to run the firm just as they always have. "We expect to continue to build our business and get The Home Depot more heavily involved in that which we understand very well," Clyde Rodbell said. "The Home Depot is one of the great successes in American business, and I respect what they've accomplished. They offer a lot of financial support that will allow us to grow our business, and they offer opportunities to attract the good folks we'll need. They do a lot of things very well."

The reaction to the announcement, including that of Apex employees, has been positive, Rodbell continued. He recalled a long-ago promise to his staff that while any decision to sell the company would consider the Rodbell family, his obligation to "the bigger Apex family" is more important.

"I feel as strongly about that as ever," he said. "I pledged to our associates that we would never do anything that wouldn't serve their best interests. A lot of companies have approached us over the years, but the ingredients weren't right until Home Depot came along with its strength and security."

The reaction from vendors and customers has been equally positive, Rodbell added. He has assured them that Apex would continue to do business as usual.

Andy McKenna, Home Depot's senior vice president/strategic development, confirmed that his firm was looking for a company with an excellent track record with plumbing contractors. "We've already learned from other acquisitions that having people who really understand the customer segments as part of our team is really very important."

As a result, The Home Depot was interested in two key capabilities that Apex provides. "We'll be able to access more product for our stores and our DIY customers," he said. "And we'll be able to learn from them how to serve the pro customer better. We were looking for experience, expertise and capability to provide product. The people at Apex have a range of knowledge that we just don't have. And they're set up to handle the pro customer in ways we can't."

The Home Depot has no plans to acquire other plumbing wholesalers, McKenna said. "Our focus now is to learn the business. We'll provide some advantages to Apex, and they'll give us some, too. From the customer's standpoint, it'll be business as usual."

Dealing with the inevitable

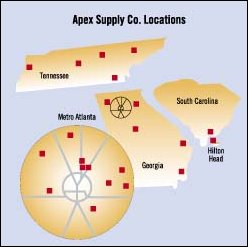

Few of the industry members interviewed by Supply House Times were surprised by the move, and the editors of this magazine have been hearing rumors about talks between Depot and Apex for several years. Probably the most often-heard comment about Depot's foray into wholesale distribution was "it was going to happen sooner or later." The fact that both firms are based in Atlanta was probably secondary to the fact that Apex is among the largest (No. 31 in Supply House Times' 1999 Premier 150) and most respected (Wholesaler of the Year in 1984 and 1998) companies in the business."It is certainly interesting, but this deal comes as no surprise to our members as rumors have been circulating for a while," said Inge Calderon, executive vice president of the American Supply Association.

Frank Rizzo, executive vice president of the Southern Wholesalers Association, agreed. "Nobody was holding their breath on this one. There is no doubt in distributors' minds that Home Depot is doing this to get into the wholesale business. But some people wonder why Home Depot would want to get into our business. Look at their profitability and ours. There's a whole decimal place between them."

Lower margins notwithstanding, Rizzo added, The Home Depot has relatively little room for growth with DIY and small-contractor customers, but it has had less success with larger professional plumbing and HVAC contractors. He believes that market segment -- the same one served by SWA members and their peers -- is the company's target.

Rizzo also speculated that The Home Depot could be looking at Apex as its fulfillment center for sales through its upcoming e-tail division. "It's a very loud wake-up call for our industry, and it's the first of many twists and turns we'll see."

However, Calderon predicts everything will be business as usual. "As long as Apex Supply continues doing business as Apex Supply, we don't foresee a problem," she explained. "The most intriguing aspect of the deal will be to watch the fallout from manufacturers, since Home Depot now has its foot in the door with the contractor business."

New route to manufacturers?

Bill Arenberg, president of Columbia Pipe & Supply (Chicago), pointed out that The Home Depot so far has not been involved in heating and air conditioning, although the company apparently has been talking to Trane about selling its line. Apex was Trane's largest wholesaler until Sears started selling Trane products this month."I don't think Apex was for sale," Arenberg added. "I think Home Depot just offered them a number they couldn't turn down. If this works for Home Depot, we'll see more of this kind of thing in other areas."

Morris Cregger, president of the Cregger Co. (Columbia, S.C.), met with executives from The Home Depot some time ago. He explained to them that if they were serious about serving the professional contractor, they would have to do it away from their retail business.

"They'll probably find that their cost of doing business in our industry will go up five or six points in relation to sales over what they're used to in retail," Cregger said. He expects other major shifts in the PHCP distribution business, too.

"In the heating and cooling business, contractors are being acquired by manufacturers. It's a cost factor. We no longer can control margins; we must control transactional costs. Cutting one or two steps cuts those costs. I think the next thing we'll see is Home Depot or Lowe's buying up one of the big contractor groups, but I wouldn't be surprised to see a major manufacturer -- Masco or Kohler -- venture into the distribution business."

Gary Daniels, senior vice president/ marketing and merchandising at Johnstone Supply (Tigard, Ore.), said: "My first impression is that this is very similar to the Maintenance Warehouse deal. Home Depot has been looking to get at the contractors' business for a long time. Apex has good management; Home Depot can gain considerable knowledge about the wholesaling industry through them."

He added that immediate impact will be regional and that the need for PHCP wholesalers will remain in spite of the "unhealthy" consolidation fever running rampant through the industry.

Turning to the pros

Home Depot is in the process of rolling out what it calls its Pro Initiative, said a home-center industry analyst who asked not to be identified. The company's plan is to go after sales of higher-margin items bought by contractors. The analyst said that at a recent meeting, a high-ranking Home Depot official admitted that of all segments of the professional-contractor market, plumbers have been the toughest to reach."This purchase is very similar to Home Depot's purchase of Georgia Lighting last summer," the analyst explained. "Georgia Lighting is known all over the Southeast for its expertise. They carry every kind of lighting fixture you can possibly imagine. They also were relatively small, private and profitable. When Bernie Marcus [Home Depot's chairman of the board] and Arthur Blank [president and CEO] decided that Home Depot should be top-notch in lighting, they decided to acquire the expertise."

John Wills, president, Masco Plumbing Products division, said that while Georgia Lighting has not undergone drastic changes since the acquisition, he's confident that Home Depot studied its operation and applied those lessons to the lighting business in the big-box or Expo stores.

"I'll bet Home Depot has learned about what sells in Georgia Lighting and what doesn't, and they understand more about that business," Wills said. "I would imagine we will see the same thing here with Apex."

In that sense, Home Depot may see Apex as a laboratory where it can learn more about the plumbing industry, Wills said.

"Home Depot would not have bought the business if they didn't think it was a big part of what they are doing," Wills reasoned. "If they think it is something that will help them, they will expand. Their attitude is to try things. Look at what they do in the stores. What works, they keep. What doesn't, they move on."

The home-center analyst agreed, noting that The Home Depot's brand new store in Alpharetta, Ga., has a lighting department that is "night and day" better than those in its previous stores. "The goal is to improve what happens in the orange box."

The analyst reported that Home Depot officials estimate the total plumbing market to be $49 billion; its own share is about 10% of that market. However, the company wants that percentage to be much greater.

"This is not a company that wastes money," the analyst added. "Home Depot put enough into Georgia Lighting to show that they're serious about learning about that business. I'm sure they'll have the Apex guys go into Home Depot's existing plumbing departments and tear them to shreds."

The same analyst doubts that The Home Depot is planning to take over the supply-house business. "But plumbing wholesalers should still be worried. The Home Depot's goal is to do well enough inside the orange box to take the business away from the supply houses. The real threat is that Apex will help Home Depot be a much more effective competitor."

The manufacturer's dilemma

Peggy Tracy, a Chicago-based consultant who has worked with ASA on the organization's restructuring, looks forward to seeing how manufacturers will react to the acquisition. She pointed out that while many companies may sell to both Home Depot and Apex, they often sell different products to each. "For a lot of these people, Home Depot is far and away their largest customer," she explained. "How do you tell your largest customer, 'No, no, no, you can't do that' when they want to start selling the entire line?"Tracy also warned that pricing in Apex's market area is going to get very tight. "Nobody buys better than Home Depot. All of a sudden, Apex is going to be the most efficient distributor in that region. Wholesalers had better figure out how to take costs out of their businesses as fast as they can. One thing you can count on here is margins getting crunched even more."

Three manufacturers that have relationships with both Home Depot and Apex Supply reiterated the 'business as usual" response as to the potential impact of the acquisition.

"Some of us in the business have looked at the situation and said we will do what we have to do to be successful and be fair to all sides," said David Siegal, president of Hercules Chemical Co. 'That is the view after a lot of soul-searching. We have continued to do business with both over the years, and each has been a profitable account for us in different ways. Provided that everybody understands -- at the present time at least -- that Apex is not Home Depot and Home Depot is not Apex, there won?t be a problem."

However, if Home Depot insists on becoming one and the same with Apex, it could become very difficult, he added. "If Home Depot runs a big spreadsheet and looks at what they pay for product going here and going there, it will require some intelligence to read that and not jump to any ridiculous conclusions," he said. "I think Home Depot has that intelligence."

Home Depot's forte is making professional products available to the consumer, said Mark Gold, vice president/marketing, Price Pfister.

"The DIY and BIY (build-it-yourself) marketplace is thriving, and Home Depot is a big benefactor," he said. "They see an opportunity to generate more professional business, but Home Depot doesn't have a large plumbing contractor base, so it makes more sense to attract that segment to an Apex."

Gold compared the Apex acquisition with the relationship Home Depot has established with its Maintenance Warehouse business, which is a complementary operation but run separately.

"I'd be surprised to see Home Depot walk away from the Apex brand name in the marketplace," Gold said.

"We have heard from the companies that business will continue as usual," agreed John Heilstedt, executive vice president/sales and marketing, Elkay Manufacturing Co. "Both companies are very good customers of ours, and we want to maintain that. We are committed to the wholesale channel and are also committed to Home Depot. They don't necessarily conflict with each other."